Brazil’s Nomad expands investment options, adds stocks and ETFs

Essa notícia está disponível em português

Nomad, a fintech that enables Brazilians to open a US bank account digitally, is expanding investment options for clients – and heating up the race to claim a slice of Brazilians’ resources abroad. In addition to investing in areas such as cannabis, innovation, and crypto, the company now allows clients to directly buy shares and ETFs.

In an exclusive interview with Startups, the head of the company’s investment area Caio Fasanella said broadening the range of products is an important step towards increasing customer loyalty. According to the executive, many clients had been using the firm’s current account and debit card tools and other options available on the market to make investments.

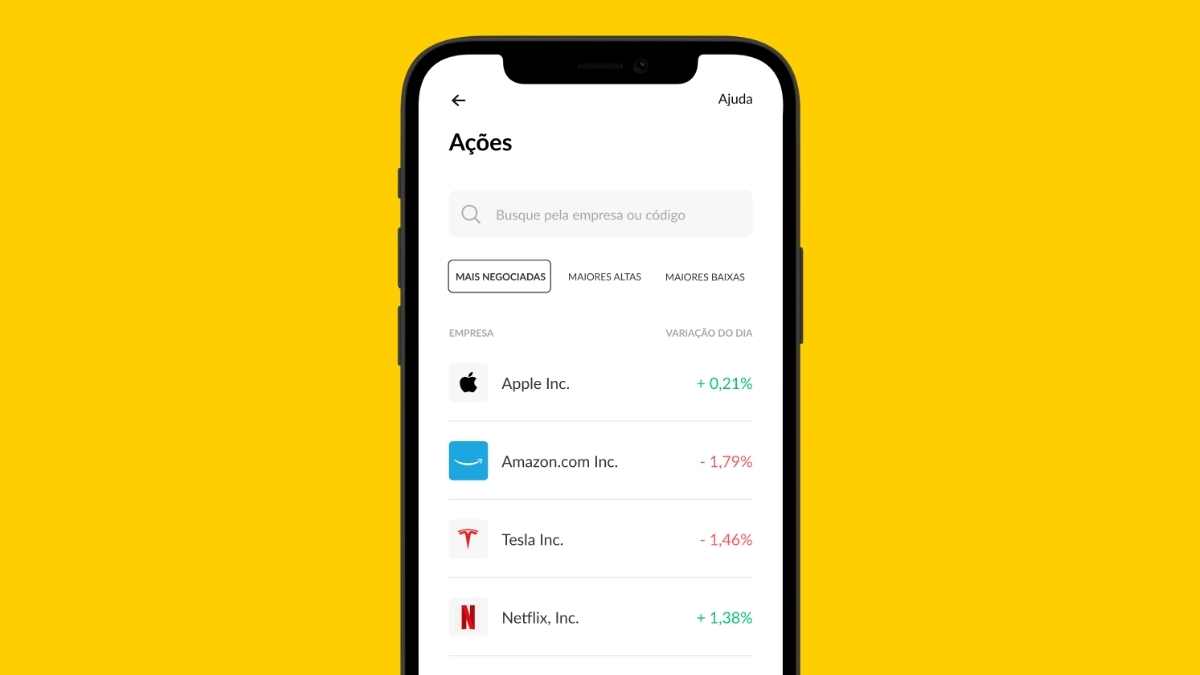

Fasanella believes the move will attract new customers since the goal was to create a simplified user experience. “Virtually, all platforms look the same and are not that simple to use. We created something that’s visually pleasant and simple, in which you only need to choose the asset and the amount to be invested. There is no risk of messing things up,” he said. The operations are backed by DriveWealth, one of Nomad’s partners. The Brazilian digital bank currently has approximately 300,000 accounts.

According to Fasanella, it took six months to create the functionality to purchase of shares and ETFs, from customer interviews to development. To simplify the tool, the company decided not to allow trades with all 8,000 assets available in the American market at once.

The goal is to carefully select what is available, focusing on companies that are more familiar to the public. Currently, there are about 150 assets such as Apple, Microsoft, Disney, and Amazon, as well as ETFs in Brazil and crypto. Nomad will expand the list over time with the help of its investment team, which currently has 10 people, or by client request.

Fasanella noted that for the time being, Nomad does not plan to offer an investment recommendation service.

Nomad’s plans also include offering more investment options – which has been part of the thesis supporting the firm’s $20 million series A closed in July 2021 – and it comes at a time when having resources outside Brazil becomes more appealing, with increasing competition for investors’ resources.

Recently, Brazilian investment management company XP Investimentos announced that it will start offering a similar option to its customers. In addition, San Francisco-based Passfolio has expanded its investments in the United States, and new players such as Sprout have emerged.

For Fasanella, it is reasonable to assume that Brazilians have an exposure of around 30% of their assets in dollars. The percentage is equivalent to the impact of the exchange rate on inflation, which guarantees protection against variations. For those who travel and shop abroad, the share should be even greater.

However, this option is still very limited, which makes room for a lot of developments in that space. “The increase in competition is a validation of our thesis,” he said.

According to the executive, despite the caution and market volatility, the timing is perfect for clients who want to start positioning themselves in quality assets and find opportunities that are below their potential. “It’s time to be opportunistic and choose interesting roles,” the executive pointed out.

Nomad has yet to launch an interest-bearing account, similar to what Bitso did with crypto and other players such as Passfolio have done. According to Fasanella, the challenge is to come up with something that addresses the expectation of profitability anticipated by Brazilians.

(translation by Gabriela Del Carmen, ediing by Angelica Mari)

Jornalista com mais de 15 anos de experiência acompanhando os mundos da tecnologia e da inovação, com passagens pelo DCI, Sebrae-SP, IT Mídia e Valor Econômico. Fundador e Editor-Chefe do Startups.com.br.