Investments in Brazilian startups see slight drop in Q1

Essa notícia está disponível em português

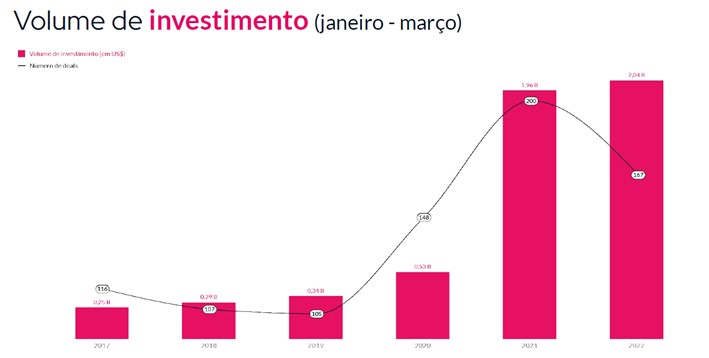

Brazil’s venture capital ecosystem continues to grow. In the first quarter of 2022, the market attracted $2 billion in investments across 167 rounds, according to research from innovation platform Distrito.

The numbers are significant, but not as high as in the trajectory seen so far, with a 4% increase in the amount raised in relation to the same period in prior year. In terms of the number of rounds, there were 33 fewer transactions.

The first quarter was so atypical that fintechs, who usually lead the local ecosystem, were not the biggest sector in terms of investment. Instead, retailtechs were favoured by VCs. Startups focused on retail secured $163 million, while those focused on financial services raised $142 million over the period.

The results seen in March weighed heavily in terms of the overall quarterly performance of the segment. Last month, Brazilian startups attracted $462 million in investments across 70 rounds. At the same time last year, there were 81 rounds, which raised a total of $958 million.

The lower number of large rounds between January and March, as well as the global risk aversion due to the effects of the Russian invasion of Ukraine, compounded by the uncertainties related to the Brazilian economic and political scenario had an impact on performance over the period.

It’s still too early to tell if activity in the venture capital segment in Brazil is about to get more restrained, as seen in other parts of the world, or that the market’s performance in the rest of the year could be impacted. “We usually have a weak Q1. But we believe the year will be similar or better than 2021”, said Gustavo Gierun, president of District, during a press event.

According to Gierun, some elements will help protect the market. Regulatory changes in China, the war in Ukraine, and a lack of good opportunities in the stock exchanges and the startup ecosystem globally may mean more capital will be diverted to Brazil. In addition, funds and management firms are capitalized and need to allocate their resources.

Gierun also mentioned that the market is maturing and more companies are developing based on the typical venture capital growth trajectory. “With more seed and Series A rounds, we will have more funding rounds, across the later stages” he noted.

(translation by Gabriela Del Carmen, editing by Angelica Mari)

Jornalista com mais de 15 anos de experiência acompanhando os mundos da tecnologia e da inovação, com passagens pelo DCI, Sebrae-SP, IT Mídia e Valor Econômico. Fundador e Editor-Chefe do Startups.com.br.